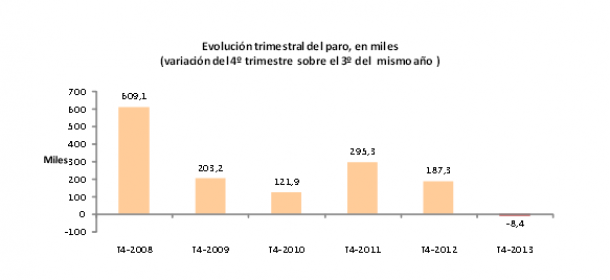

Falling housing prices, unemployment, economic contraction and tightening the conditions for access to credit have led to nearly 10 % of Spaniards mortgaged drag a mortgage bubble, ie a the mortgage is worth more than the price of your home.

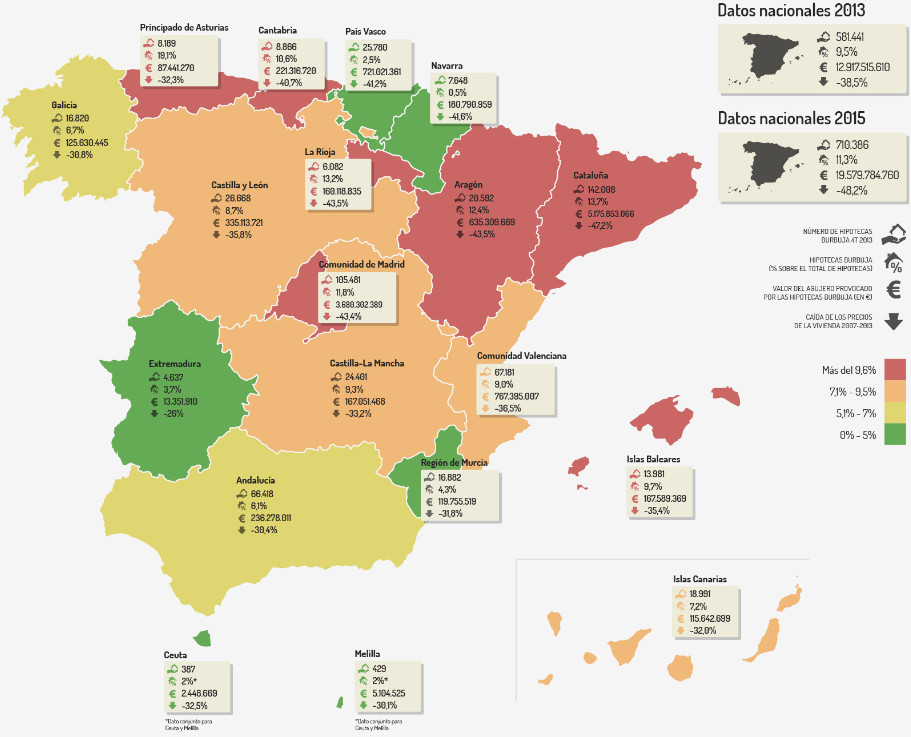

In particular the number of mortgages that are worth more than the property has soared, going from 14,333 homes affected back in 2009 to 581,441 in 2013, according to the website kelisto.es recent comparison.

The company expects that this year the number of such mortgages increased to 668.940.

Currently one in every 10 property owners mortgaged in Spain is trapped in a house that is worth less than the loan that is payable ( 9.5%), a rate that will rise to 10.7% in 2014 and 11,3% by 2015. This means that the hole or gap between mortgage debt and house price is 22,216 euros on average per household, resulting in a total of 12,917.5 million euros according to kelisto.es, This figure will increase by 29.5 % in 2014 (up to 16722.15 million) and 17% in 2015 ( 19579.7 million).

The reasons behind this negative situation are unemployment, the economic downturn, the mortgage closing faucet and falling house prices. kelisto.es ensures that housing prices fell 38.5% from their highs in 2007 and could be estimated to drop 8.5% in 2014 and 8% in 2015, although some of the bigger banks think that the market has bottomed out and prices may start to rise this year.

The autonomous communities, Catalonia and Madrid are accumulating a greater number of homes with the “mortgage bubble”, 42.5% of the total (247,489), specifically 24.4% (142 008) was in Catalonia where they could reach 155,347 in 2015, the remaining 18.1% (105 481) was in Madrid, where that could possibly reach 116,208 in 2015.

For the preparation of the report kelisto.es utilised the value of the mortgages at the regional level that facilitates the national statistical institute (ine) and Spains bank data on the relationship between the value of the property and the mortgage amount owed (loan to value). Future projections are based on the pricing model of the center housing of economics and business research (Zebra) for Spain, which includes projections on mortgage lending, housing supply, GDP and employment trends.

The study focuses on mortgages approved at loan to value ratio above 80%, when the value of the outstanding mortgage exceeds the value of the house these mortgages are defined as a “housing bubble”.