The sale of homes, the price, the stock of unsold homes and the rental market are among the ten leading indicators of the residential property market. The latest report from the Institute of Business Practice ( IPE ) notes that six of them continue to worsen while four of them have improved, so in his view the construction of homes has already bottomed out and the stock of homes is starting to shrink.

– Real estate transactions : The sale of homes rose earlier this year due to the effect of the personal income tax relief in VAT and rising, ipe estimated that at the end of 2013 there will be another spike in this type of operation

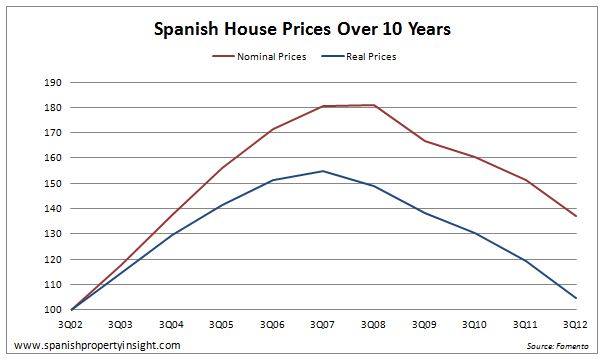

– Housing prices : The value of homes continues to decline but at a slower pace. addition , the latest statistics from the ministry building pointed to a rise in the price of houses in four CCAA

– Mortgages: Loans for homeownership continues its pace of decline and improvement is glimpsed

– Construction of new work: Building houses stabilizes but these figures do not reach a sixth of what they were in the time of the boom. this figure is expected to end the year at 90,000 new homes

– Stock of unsold homes : The stock began to decline, albeit timidly in 2012. This year the decline has been substantial, in particular, it has gone from 872,697 to 777,000 homes

– Renting : The problem of unemployment has sunk the rate of families who choose to go into home ownership, and thus has increased the number of rental leases

– Collection : Real estate fund in 2006 was 43,200 million euros and now it is just over 9,300 million

– Financial effort of families : The percentage of annual income families must spend to pay the housing moves to 31.9 %, the lowest since March 2002

– Rehabilitation of buildings : There are no statistics that reflect the reality of this business given since visas are not required

– Foreign investment : According to figures from ipe, house sales by foreigners has increased by 17%

Article By Rughead