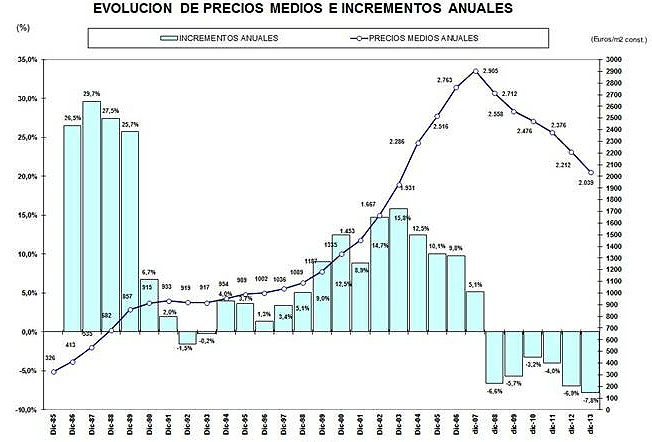

The average price of new housing in the provincial capitals in Spain fell by 7.8% in 2013, according to a newsletter produced by the St-Sociedad de Tasación valuation company. The average price of new housing in the provincial capitals fell to 2,039 euros per m2, which represents 183,500 euros for a home of an average of 90 m2. On the other hand the appraiser estimates the price of apartments will continue its downward trend, although in some locations price falls may be less ” sharp ” than currently.

Nothing new as far as the price of housing is concerned, so the value of new homes in Spain ended the year with an average drop of 7.8% in the provincial capitals, according to the latest data. In December 2013 the average market price of new housing in the provincial capitals stood at 2,039 euros per m2 built, representing 183,500 euros for a home of an average of 90 m2.

Prices have achieved a maximum fall from a drop of 38.9 % in real terms. This percentage decline from the maximum is equivalent to 63.6% of the revaluation of assets observed, which puts us in the top level pricing of 2002 according to figures of the appraisal company.

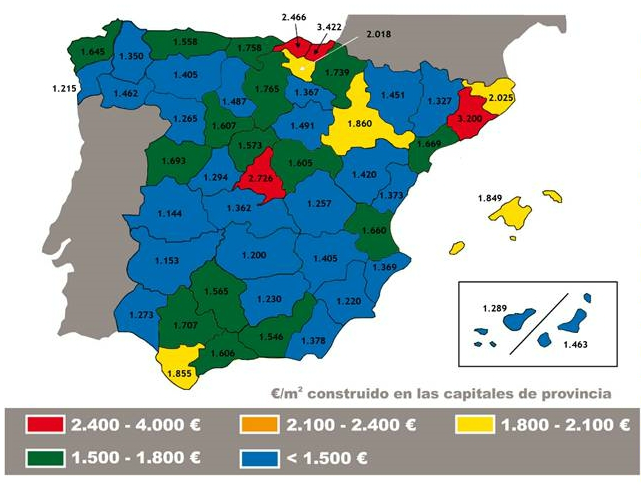

By provincial capitals

During 2013 the average price of a new home decreased in all provincial capitals, cities with higher unit prices are San Sebastian / Donostia (3,422 euros per m2) , Barcelona ( 3,200 euros per m2), and Madrid ( 2,726 euros per m2). Spains cheapest capital provinces are: Cáceres , Badajoz and Ciudad Real with unit prices that do not exceed 1,200 euros per m2. Between provincial capitals with the highest annual price change are Ciudad Real ( -13.4 %) , Guadalajara (-12.6 %) and Zaragoza (-12.2 %).

In nine capitals the average prices are down more than 10% compared to 2012, 29 capital cities have dropped between 5% and 10%, in the remaining 12 prices have declined less than 5%.

On the other hand in 4 provincial capitals ( San Sebastian / Donostia, Barcelona, Madrid and Bilbao ), where the national average price of 2,039 euros per m2 is exceeded. In 11 capitals (Cáceres, Badajoz, Ciudad Real, Pontevedra, Murcia, Jaén, Basin, Zamora, Huelva , Tenerife and Ávila ) the average value does not exceed 1,300 euros per m2.

Evolution

The Spanish economy that has continued in the negative since 2012, from -1.6 % in the third quarter of 2012 to -1.1 % in the third quarter of 2013, with a small upturn towards the end of the period in the last quarter. Experts predict that the economy in Spain will grow, if only marginally in 2014.

Economic indicators that have influenced the behaviour of the housing market have evolved as follows:

• The euribor, which is the reference of mortgage lending has kept it´s decreasing trend during 2013, falling at the end of November to around 0.5 %.

• the CPI has maintained a flat trend during the second half of the year with accumulated inflation in the first eleven months of the year which reached 1.2% ( 3.9% in 2012) and the year in November stood at 0.2 % (2.9 in 2012).

• The unemployment rate remains in the second half of the year at a slightly decreasing rate that will likely continue in the coming months.

• The real estate housing market has reduced its level of activity as a result of the continued difficulties in obtaining financing and the factors listed above, the downward trend in prices remains.

• Despite this in the latter part of the year it seems the forecast made at the end of 2012, that the reduction in prices could encourage entry into the Spanish market for foreign investment groups capable of absorbing large volumes of houses has been confirmed.

Forecasts

Macroeconomic forecasts for 2014 estimate that the Spanish economy could improve, most recently observed figures suggests that it could reach into positive growth figures, although it is likely that this growth is insufficient to allow the generation of stable employment.

Inflation according to the trend of recent months will probably stabilize at around 1 %, the decline in inflation over the previous year is insufficient to offset the reduction of revenue in a significant proportion of families, making it likely that real disposable income for house owners is down compared to previous periods. This effect will be enhanced by the impact of high unemployment and job uncertainty and require more effort in the household economy for the purchase of a first or second home.

In 2014 the supply of new housing will remain important, the recent entry into the Spanish property market of foreign investment funds may induce acceleration in the absorption of stock already built, which entails a certain revival of the sector.

Apart from the aforementioned funds, it is anticipated that demand keeps – with some exceptions point – the position of weakness that has been characterized in recent times and to continue, at least for some time the trend of negative growth in the prices until the surplus of existing supply is absorbed.